FACTOR-BASED INVESTING

FACTOR-BASED INVESTING

Factor Investing 101:

The Basics

Before providing an overview, let’s review what they are and why they work.

Factors are broad, persistent drivers that can explain performance across many asset classes.

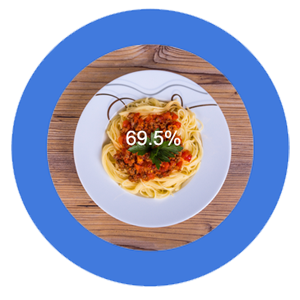

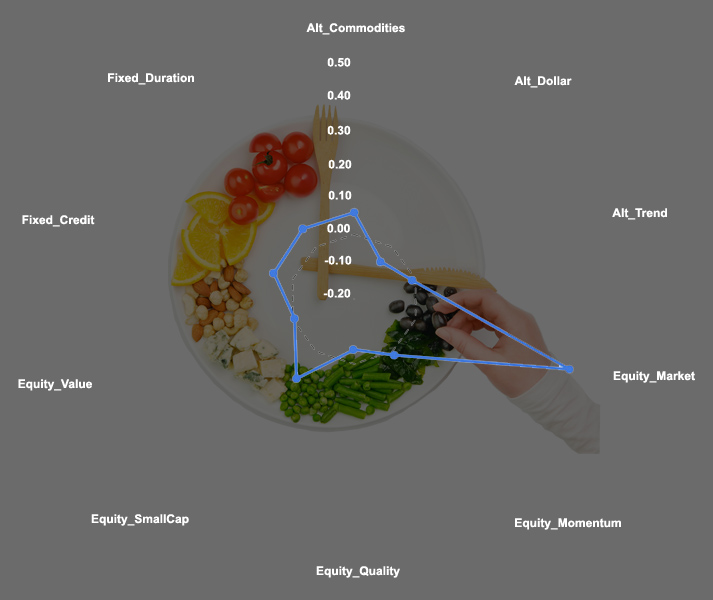

Putting together a balanced diet means understanding what nutrients are contained in our food, and choosing the mix that best supports your body’s needs.

Similarly, knowing the factors that drive returns in your portfolio can help us choose the right mix of assets and strategies for your needs.

Factors continue to work over time due to 3 evergreen reasons:

- Qualitative aspects, such as risk tolerance (please see my previous articles on Psychometrics and Stress Testing), as well as

- More quantitative aspects, such as risk required and

- Risk capacity (also Digital Financial Planning).

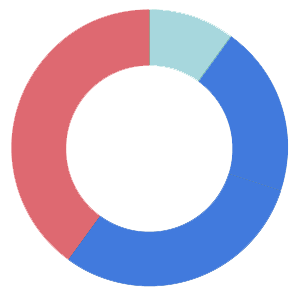

60%: HWM Moderate Asset Allocation

Holdings by Asset Class

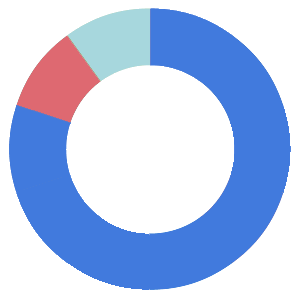

Cash Weight: Portfolio

Contribution to Volatility by Asset Class

Contribution To Vol

Factor Investing 202:

The Conundrum

Ever since the Global Financial Crisis, sophisticated investors have embraced the Endowment Model by utilizing alternative asset classes and strategies. Unfortunately, many approaches either had limited track records, or did not fit neatly into Morningstar style boxes or asset allocation pie charts, and, and ultimately delivered mixed results.

Over the past 10 years, there has been no breakthrough paradigm to reconcile competing methodologies – until very recently..

Factor Investing 303:

The Next Evolution

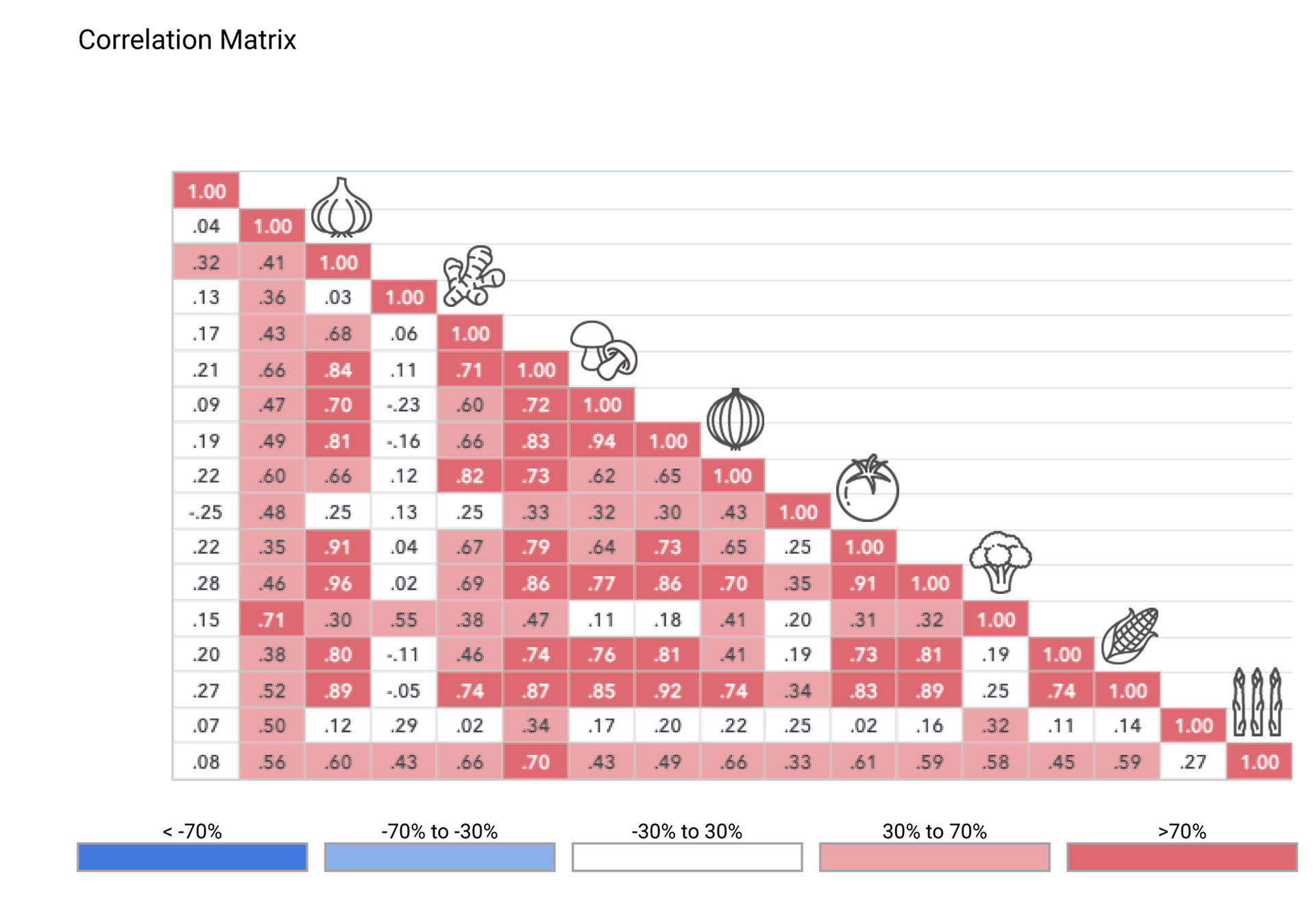

With advances in technology and expanding data sources, we can now access macro and style factors with ease using returns-based analysis.

Taken together a Global, Multi-Asset Factor Model can possibly:

- Organize traditional and alternative investments more comprehensively,

- Quantify and express factors more deliberately

- Differentiate seemingly similar investment approaches, and even

- Replace higher-cost fund managers using more efficient vehicles.

Currently, institutional investors are transitioning away from decades old frameworks by laying factor-based analyses alongside them.

Factors comprise the foundation of investing, much like the nutrients found in the food we eat.

Get In Touch

One Pine Corporate Center

Suite 200

6021 Wallace Road Extension

Wexford, PA 15090

(412) 600-2725

mlynn@hampton-wealthmanagement.com

Investment advisory services offered through Cambridge Investment Research Advisors Inc. a registered investment advisor.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, to residents of: Arizona, California, Florida, Massachusetts, New Jersey, Oregon, Pennsylvania, South Carolina, Tennessee and Washington.

Cambridge and Hampton Wealth Management are not affiliated.